- 1. While this specific feature is available for free, certain other transaction fees and costs, terms, and conditions are associated with the use of this Account. See the Accountholder Agreement for more details.

- 2. The Overdraft Protection (“ODP”) Service is an optional service made available to eligible Customers by Pathward. Once you enroll and meet eligibility requirements, you will be charged a $15 fee for each purchase or transaction settlement greater than $5 that occurs while your Account available balance is overdrawn beyond the $10 Balance Buffer, up to four (4) Overdraft Protection Services Fees per calendar month. Any negative balance must be repaid within thirty (30) days. Whether we authorize an overdraft is discretionary, and we reserve the right not to pay. For example, we may not pay an overdraft if you fail to meet the eligibility requirements or attempt too many transactions or transactions that create too large of an overdraft. Contact Customer Service or log in to your Account for full terms and conditions that apply, including eligibility requirements and standard overdraft practices. This service may be expensive, so we encourage you to research alternatives before enrolling. Once enrolled, you may opt-out at any time; however, you are responsible to repay any overdrawn amounts on your Account even if you opt-out of the service.

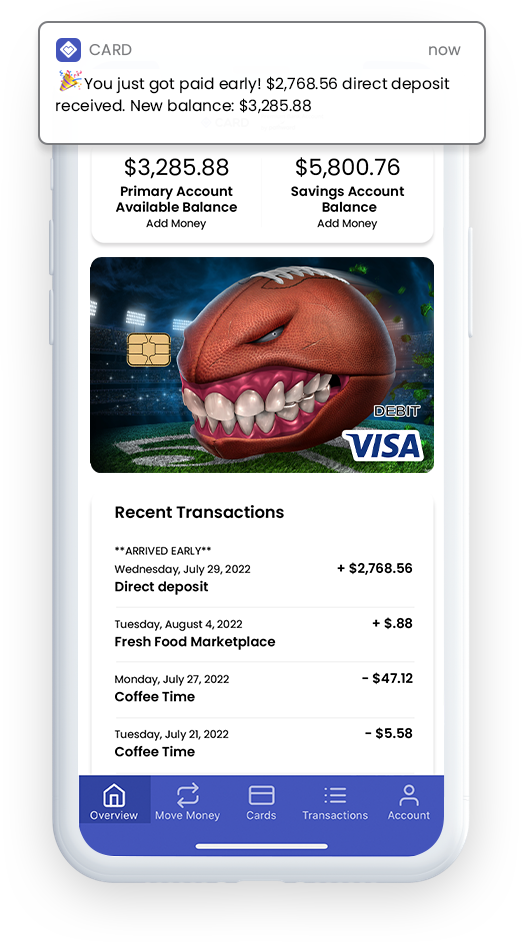

- 3. Faster access to funds is based on a comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct Deposit and earlier availability of funds are subject to payer's support of the feature and timing of payer's funding.

- 4. The Savings Account linked to your CARD Premium Bank Account by Pathward is established by Pathward, N.A., Member FDIC. Interest is calculated on the Daily Balance of the Savings Account and is paid quarterly. The interest rate paid on the entire balance will be 0.0499% with an annual percentage yield (APY) of .05%. The interest rate and APY may change. The APY was accurate as of 08/17/2020. The minimum balance required to open the Savings Account is $10. The minimum daily balance required to obtain the advertised APY is $10. You must receive one (1) payroll or government benefits direct deposit to be eligible to open a Savings Account. Savings Account funds are withdrawn through the Premium Bank Account and transaction fees could reduce the interest earned on the Savings Account. Funds on deposit are FDIC-insured through Pathward, N.A., Member FDIC. For purposes of FDIC coverage limit, all funds held on deposit by the accountholder at Pathward will be aggregated up to the coverage limit, currently $250,000.

- 5. This is an optional service and is not a Pathward or Visa product or service nor does Pathward or Visa endorse this offer.

- 6. Standard data rates, fees, and charges may apply.

- 7. Funds are FDIC insured, subject to applicable limitations and restrictions, when we receive the funds deposited to your Account. CARD is not itself a bank or a FDIC-insured institution and the FDIC's deposit insurance coverage only protects against the failure of a FDIC-insured institution. Pathward, N.A., is a FDIC-insured depository institution.

- 8. Third party bank fees may apply.

- 9. Mobile Check Capture is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding at Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for message and data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your account. See your Deposit Account Agreement for details.

- 10. Important information for opening an Account: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires all financial institutions and their third parties to obtain, verify, and record information that identifies each person who opens an Account. What this means for you: When you open an Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other documents at any time.

- 11. Information courtesy of Apple.

* Visa's Zero Liability Policy* is our guarantee that you won't be held responsible for unauthorized charges made with your account information. You're protected if your Visa credit or debit card is lost, stolen or fraudulently used, online or offline.

****NOTE: *Visa's Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your issuer for more detail.

The Card Premium Bank Account is a checking account established by, and the Premium Visa® Debit card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc, and can be used everywhere Visa debit cards are accepted.